Gold -1.40% Spot: Alert bearish: evening star formed

Gold reached yesterday during New York session on a new record $ 1,440 an ounce, but buyers have come to give ground before the close. And finally, gold closed at equilibrium on the day, which was materialized by the appearance of a doji, which more and on top of an uptrend. Bad sign, but this is just the beginning.

multiple adverse signals:

It was only a first warning to all Gold Bulls who swarm after 10 years of uninterrupted growth. This warning was in actually accompanied by a reversal of my oscillators, namely the RSI and William's Percent Range. The RSI is out of the overbought zone which is commonly considered a strong bearish signal.

But if I write a short note about the precious metal tonight is because the market has confirmed these early bearish signals. On the chart has formed a beautiful evening star, evening star doji for purists, as I noted this morning on Twitter. This figure, when it appears at a marked upward trend heralds a movement correction. Moreover, the Evening Star has the merit of work very often, especially since it appears relatively rarely.

(NB: Evening Star = significant bullish candle followed by a doji, which itself followed by a bearish candle similar to the first).

prudent Note:

So obviously I'm not an expert on gold. I've often been fooled by the Gold Bulls in the past. To me the signal is very clear: to place down. Only caveat: in the last hour of trading, the bulls managed to keep prices above the trendline that supports ongoing since late January, and has accompanied a rise of 10%. A monitor then.

How to react?

Two options are offered to us: recovery from this bullish trendline (knowing that borders on overheating) or release the bears!

I'm more willing to take short positions rather than vice versa. So tomorrow I will be monitoring all attempts to pass under this trendline (perhaps as early as tonight). If it works, I will ship with the Bears for the yellow metal to plunge towards the symbolic 1,400 minimum (I know that $ 1,400 is next door), and probably moving average which is 20 sessions currently about $ 1,387 an ounce.

If we do, I can write a new note on gold, if not just a few messages on twitter. Meanwhile good night and remember that in general, the future belongs to those who rise early.

Who Let The bears out?

ASSOCIATION BUSINESS PLANETE Jeune "APBJ"

Thursday, March 3, 2011

What Does A High Esr Mean

Agricultural Futures: Wheat, Corn & Soybeans: Record food prices by FAO!

Hello. A nice sunny day starts, punctuated by the press conference of our national Jean-Claude Trichet, who gives a big boost to the single currency, the highest of the year 2011.

Hello. A nice sunny day starts, punctuated by the press conference of our national Jean-Claude Trichet, who gives a big boost to the single currency, the highest of the year 2011.

The topic today will be the future of agriculture on which I rise steadily since last summer.

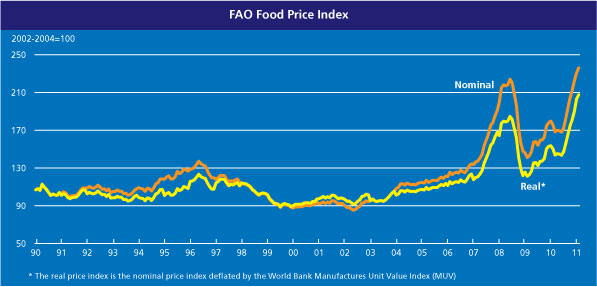

FAO or UN agency Food and Agriculture has issued this morning's food price index. Since this index exists, ie for 20 years, food prices have never been so high and far exceed the levels reached in 2008. The main contributors to this increase include cereals and dairy products. Sugar prices fell slightly which helped limit the rise in the index as a whole.

Concerning cereals, the explanations of the upward trend is clear: rising demand against a backdrop of population growth and diversification of the diet of many categories of countries emerging, and gives too low to satisfy the latter. Grain stocks are very limited and many areas crops have been or will be disappointing: Floods in Australia, severe drought in Russia, Ukraine last summer in China this winter ... And goes on, the list could be long.

All this to make it clear to the attention of anti-globalization and other socialists in no case the fault lies with financiers. It is certain that the volatility of agricultural prices is compounded by the fact that foodstuffs are also financial assets, but this upward or downward. Farmers and other traders are doing very well themselves for accentuating the upward pressure on stockpiling rather than flowing throughout their production. And again, it is not that large groups of agribusiness. To the lowest peasant Chinese all stakeholders are involved. In all cases, the current surge in agricultural prices can not be eternal, although nothing indicates that it has come to term, for the simple reason that the next harvest will be far larger, except in cases unfavorable weather conditions. However, I can not deny that the overall trend is upward, but I think it reflects the realities of agricultural markets, torn between strong demand and the limitations on increasing production.

Now that my short message against so-called anti-humanist profits (I doubt they will read it, but if that is the case I would appreciate feedback!), I can devote myself to presenting my opinion on wheat, corn and soybeans.

- Wheat: Wheat Futures (CME, May) : The contract has lost ground to the short month of February, down 7% but still at high levels. The situation is particularly interesting because the contract operates in a clearly defined trading range: between $ 797-800 for the lower bound and $ 830 for the lower limit.

Yesterday, sellers took the hand in mid-session, up to test the lower bound of the range, where the rebound was instantaneous. He formed a triple bottom, which is a major support for future sessions, under which the protective stop orders and orders seem very many shorts.

Note that the demand for Wheat is still strong, including a large order placed last week by Saudi Arabia on 275 000 tonnes of wheat. However it seems that larger players looking to get rid of some contracts, which explains the downside access sudden.

I'm short on $ 796 with the 780 or even $ 760. Any attempt downward under the $ 800 seems repelled instead be a buying opportunity with a return in the upper range of expected soon. In case of exceeding the $ 830 closing and beyond this level, it is probably a go as wheat test the $ 850 in the wake of the upward trend would boost the standby time. Note that I favor the short positions, especially as weather conditions tend to improve for the crops covered by this contract.

-Corn: Corn Futures (CME, May) : It is probably the most dynamic agricultural contract at the time, with very very low stocks ... Again, the fall of the day was quickly offset by buying cheaply at $ 707, key support. Beyond I'm bullish, with a major resistance point out at $ 740.

-Soybeans: Soybean Futures (CME, May) : Maybe the contract for which I 'm more socialized. Crops in South America appear to be satisfactory, but the abundance rainfall recently could be harmful, which explains much of the performance of the day .. Moreover, Chinese (soy wholesale buyers) prefer to buy their soybeans in South America, while a cargo of U.S. soybeans had been canceled. but this news is already very cool.

The closure was performed on a resistor and in contact with the moving average and 20 sessions. Go higher would be for me a new bullish sign that would open the way for $ 1,420 or $ 1,440 (level significant enough), but this may occur at the opening of CME at 16.30 French time (Very difficult for me to place an order with correctly priced deferred

...). However, if the opening is below, I have a slight preference bearish, having already shorts the contract yesterday for a few tens of minutes. Say that failure to cross the $ 1400, it is highly probable that I decided to go short, while remaining cautious as expected area supports the $ 1370-1380. If the market closes below, attention to early extension of the possible movement to the critical support of $ 1,350.

NB for beginners: A contract represents 5,000 bushels, or about 127 tons. The value of one tick (0.25 points) is $ 12.50, you get easily amount to a contract.

Note 2: Very often, websites refer to the price per bushel (bushel) . To get it, simply divide the price of the contracts by 100.

Good trades and excellent day.

Subscribe to:

Comments (Atom)