: Turning bearish after the failure of crossing the $ 90? The EIA has recently raised its forecast for oil demand growth for 2011, while confirming the increase in consumption in the U.S. over the last quarter of 0.6% over the previous year. At the same time, OPEC decided yet the status quo in its production, and reiterated that a price between 70 and $ 80 was a good price. But we're closer now than $ 90 of that range, and OPEC actually think that current prices should not last. For them, the blame rests on time, while a cold wave prevails on both sides of the Atlantic, as well as the weakness (relative) of the U.S. Dollar. Spend on these considerations.

Oil has found its highest levels since September 2008, in line with market indices finally, and the dreaded 100 per barrel is now just a short distance . Prices are still within a bullish channel clear, with no movement "excessively" bullish.

|

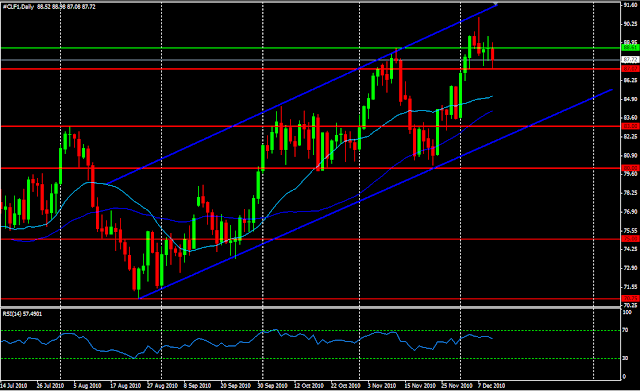

Crude Oil Futures (JAN2011), Daily

The bulls seem yet to want to take a break. I've been bearish since last week as I mentioned on my Twitter. At the beginning of the week I would monitor the behavior of players in contact with $ 87.00. This is a major support level after successfully stopped the attacks bullish spring.

I marked preference for short time, and I planned to go short again in case of breakage of the support of $ 87.00. The aim would be to drop the $ 86 rally in less than 24 hours to confirm the importance of the movement. Subsequently, I think the potential downside could bring back lessons in the area of $ 82.70-83.00, since the moving average and 20 sessions fail to reverse the trend. And why not $ 80 in January? To do this will require rather uncertain conditions in the markets, but anything is possible.

I favor this scenario, but it will be truly the market showing signs towards this purpose in the early sessions of the week. Otherwise, if prices are rising again, the passage of $ 88.61 will be a first sign, which should be confirmed by an excess of 90.00 in the wake and the rallying of a new annual high. I have not yet planned orders to take advantage of this possibility, I will detail if needed later in the week.

good trades, good week and good Christmas shopping.

|

0 comments:

Post a Comment